The Wild Community Impact Investment FundInnovative Impact Investment Opportunity

The Wild Community Impact Fund (Fund) is a ground-breaking social impact investment combining climate action with delivery on the UN Sustainable Development Goals. The Fund offers impact investors a unique triple bottom line of financial returns alongside measurable and independently verified economic, social and environmental impact. Through a focus on blended value investments that deliver the highest calibre social, environmental and economic performance, we aim to demonstrate that financial performance can be fully aligned with sound environmental stewardship and social development.

The Fund is designed to give real estate and impact investors exposure to a diversified portfolio of Ecovillage property providing economic value combined with positive regenerative social and environmental outcomes.

The Fund will be a listed property trust with the primary strategy of investing in freestanding residential property in rural and peri-urban areas by developing and regenerating land. The Fund is focused on seeking to achieve long-term returns through potential long-term capital growth and some income from rental yields.

Features of the fund include:

- Combines climate action with delivery on the UN SDG’s

- Land banking – no land will be resold

- Offers impact investors a unique triple bottom line of financial returns alongside measurable and independently verified economic, social and environmental impacts.

- Highest calibre social, environmental and economic performance

- We will demonstrate that financial performance can be fully aligned with sound environmental stewardship and social development.

A dedicated team of highly-skilled professionals manages every aspect of the real estate investment process – from acquiring the properties, masterplanning and rehabilitating the assets, to leasing the homes and ongoing tenant and property management.

The Fund aims to deliver attractive returns to unitholders by:

- Acquiring land in select neighbourhoods throughout the Fund’s target investment area at attractive valuations

- Restoring and renovating properties, to the highest standard, adding value through masterplanning sustainable and regenerative ecovillages

- Maximising capital appreciation by providing ecovillage tenants with quality property management services.

The Fund provides sustainable, regenerative masterplanning to the ecovillages, covering housing and common areas, holistic land management – from natural forests to landscaping built areas, creates green energy and circular systems, localises food production and provides business centres with the aim to generate attractive long-term capital growth.

Generating Real Measurable Impacts - Social, Economic and Environmental

Whilst investing in property and generating strong results for unitholders, the Fund also provides strong social, economic and environmental impacts. In fact, we intend to address all the the UN’s Sustainability Development Goals and in the process making our local communities more resilient and healthier places to live.

Transparency and Impact Measurement The usage of funds and financial statements will be reported fully open book regularly. Best practice Fund reporting metrics will be reported. Additionally, each of our Objects’ impact goals will be measured and reported on.

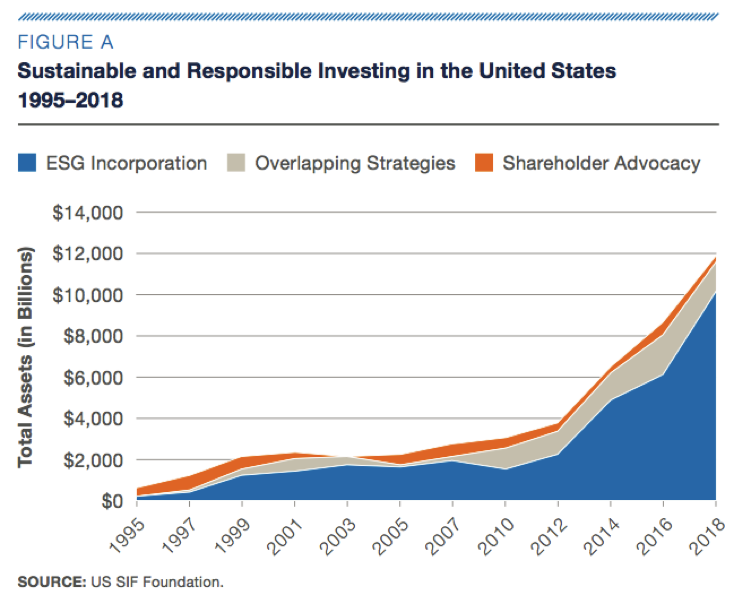

The OpportunityMassive growth in the responsible investing sector

The US SIF Foundation’s Report on US Sustainable, Responsible and Impact Investing Trends identified $12.0 trillion in total assets under management at the end of 2017 using one or more sustainable, responsible and impact investing strategies. Reference USSIF

Key Fund Details and Target FinancialsThis is general information only. Figures are target outcomes that are still under development.

Target Return

4 to 8% p.a. after fees and costs, before tax

Target Yields

2 to 4% p.a. distributed quarterly

Target fund value

$100m aud Initial tranche expanding to $1bn+ aud over time

Liquidity

No redemptions, units may be sold on the secondary market. Initial lock up period of 3 years for investors in each tranche.

Fees

Management fee of 1%p.a. of the Fund’s NAV. Performance fee of 10% of returns with a high water mark

Risks

Like all investments, an investment in the Fund is exposed to a number of risks, which may either individually, or in combination, materially and adversely affect the future operating and financial performance of the Fund, its investment returns and value of an investment in the Fund. Like all investments, an investment in the Fund carries risks which may result in the loss of income or principal invested. In addition to the general risks of investing, specific risks associated with investing in the Fund include, but are not limited to development risk, property market risk, taxation risk and foreign exchange risk.